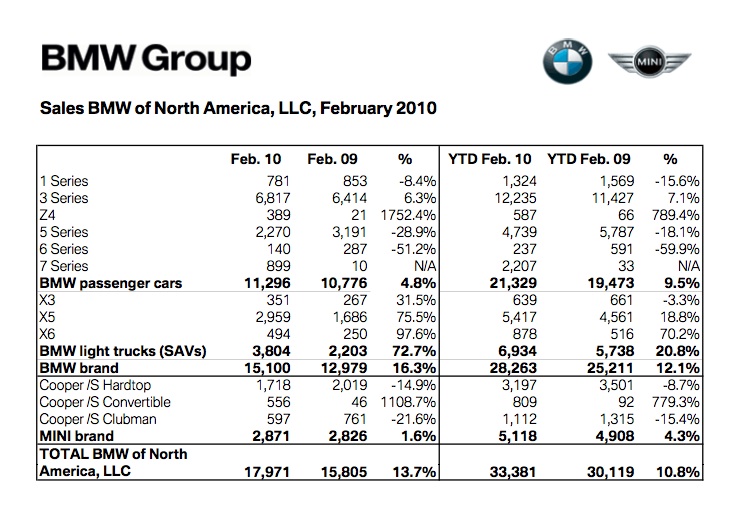

BMW US Sales in Feb 2010

3-Series — 6.3% growth is good in today’s market. I would certainly be happy if CTS had growth in sales year / year. The upcoming Cadillac ATS will have to be in this range of sales / month if it is to compete with the 3-Series.

Also note that 3-Series sales are up strongly from January 2010. As we move further into the corporate bonus and pay raise season do BMW sales show an uptick?

5-Series — down 28.9% is worrisome. Cadillac CTS again outsold BMW 5-Series. A new 5-series is on the way, which may be muting sales? Sales of the 5er are down from Jan 2010 as well.

SUV — Cadillac SRX sales in Feb of 3,465 were just below BMW SUV sales of 3,804. More room for growth of SRX sales there. Total Cadillac SUV sales, including Escalade, exceeded total BMW SUV sales.

Joke of the day: What does Cadillac have to do to match BMW SUV sales? Cut Production.

Total US sales for BMW for Feb 15,100 versus Cadillac sales of 9,273 units highlights the additional runway Cadillac has for vehicle sales. Cadillac is bringing the ATS to compete directly with the 3-Series, but it can’t get here soon enough for Sales.

Obviously the XTS to replace the fast-fading DTS would also help a great deal.

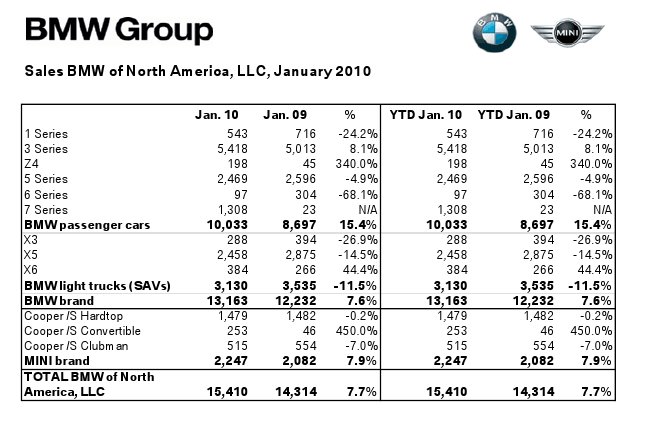

Here was the similar sheet from Jan 2010:

And here was our Feb 2010 Cadillac chart for comparison:

| February | (Calendar Year-to-Date) | |||||||

| January – February | ||||||||

| 2010 | 2009 | % Chg Volume | %Chg per S/D | 2010 | 2009 | %Chg Volume | ||

| Selling Days (S/D) | 24 | 24 | ||||||

| CTS | 2,690 | 3,259 | -17.5 | -17.5 | 5,255 | 6,677 | -21.3 | |

| DTS | 611 | 982 | -37.8 | -37.8 | 1,229 | 2,344 | -47.6 | |

| Escalade | 1,418 | 1,238 | 14.5 | 14.5 | 2,655 | 2,591 | 2.5 | |

| Escalade ESV | 552 | 416 | 32.7 | 32.7 | 948 | 1,088 | -12.9 | |

| Escalade EXT | 102 | 166 | -38.6 | -38.6 | 223 | 501 | -55.5 | |

| SRX | 3,542 | 552 | 541.7 | 541.7 | 6,776 | 1,440 | 370.6 | |

| STS | 332 | 357 | -7.0 | -7.0 | 565 | 770 | -26.6 | |

| XLR | 26 | 68 | -61.8 | -61.8 | 62 | 126 | -50.8 | |

| Cadillac Total | 9,273 | 7,038 | 31.8 | 31.8 | 17,713 | 15,537 | 14.0 | |